Growing up, I was a huge fan of talk radio. One of the voices I remember quite fondly from my childhood was that of Paul Harvey, whose program The Rest of the Story would present the little-known facts of an otherwise well-known story. As the president of a small, private university, I pay close attention to media reports of the rising cost of college and recognize there is so much of the story that remains untold.

While dramatic increases in the sticker price of college makes for exciting sound bites, there is more to this story than meets the eye.

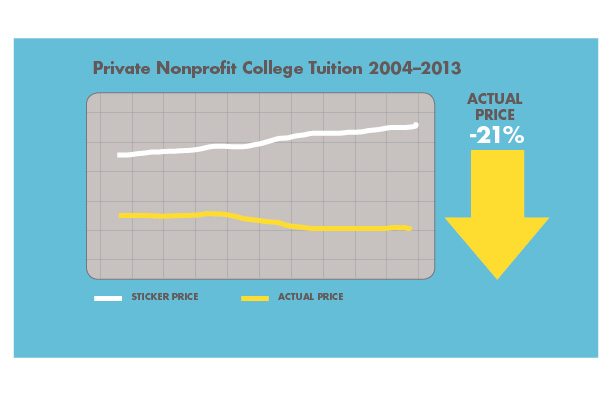

The College Board recently published a new report, Trends in College Pricing. Most of the data presented throughout the report focuses on published tuition trends. While dramatic increases in the sticker price of college makes for exciting sound bites, there is more to this story than meets the eye. In 2004-05, while the average published tuition and fee price of 4-year private nonprofit colleges was $25,000, the net price (what the average student actually paid after institutional scholarships, grants and discounts) was less than $15,000. Ten years later, in 2014-15, while the sticker price had risen to $31,000 (an increase of 24% over ten years), the net cost had decreased to $12,000. Yes, you read that right.

The actual cost the average student paid to attend a private nonprofit college has actually gone down over the last decade-by 21%! I’ve been president of Oglethorpe University in Atlanta for almost a decade. Despite the narrative of rich private colleges getting richer at the expense of middle class families, the reality is that most private colleges in America look a lot more like Oglethorpe than Princeton or Harvard. In 2014, our net tuition was just over $12,500 per student, close to the national average.

I don’t worry much about the top 50 or 100 institutions; 10 years from now, they will all still be among the top 50 or 100. Collectively, however, they educate a very small slice of this country’s students. The real question concerns the economic survival of the rest of us who together educate many, many more times the number of students (and often students who come from less privileged circumstances).

Most institutions that stand a chance of thriving bring something unique to the table. Oglethorpe is blessed with a beautiful campus in the dynamic and growing city of Atlanta, which is a hotbed of experiential learning opportunities.

One solution is recognition by federal and state governments that higher education is an investment they ought to be making on behalf of young people and our society as a whole. President’s Obama’s recent proposal regarding community college financing is one promising idea. That kind of investment is happening in almost every other country in the world, but here at home, we have actually been dis-investing from education. It’s hard to imagine this strategy will turn out very well, but we certainly seem committed to it. So, if that’s not in the cards, what other positive solutions can I offer?

At Oglethorpe, we are addressing these challenges in two ways. The first is focusing on our core enterprise and unique value proposition. Most institutions that stand a chance of thriving bring something unique to the table. Oglethorpe is blessed with a beautiful campus in the dynamic and growing city of Atlanta, which is a hotbed of experiential learning opportunities. We have used this to our advantage and seen enrollment growth ten years running. But even an excellent manifestation of your differentiating principle is not likely to provide sufficient ballast for institutions lacking a large endowment. In order to thrive, most schools will need to create additional routes to supplement their core business.

We have pursued three such strategies at Oglethorpe. All three have rapidly achieved significant scale through the formation of partnerships. In the fall of 2012, Oglethorpe partnered with the world’s largest language learning provider to open an English language institute on our campus, designed to attract college age students from across the world to Atlanta. The program has grown from seven students in October, 2012 to 260 in the fall of 2014.*

At the same time as this venture began, we opened a new study abroad program through a second partnership. In the summer of 2014, over 200 students from more than 30 different universities enrolled in an Oglethorpe-branded study abroad program. These students are taking Oglethorpe-designed courses, taught by Oglethorpe faculty. Between these two programs, Oglethorpe’s identity as a global university has grown and our bottom line has improved by well over one million dollars.The third partnership is of a different nature, but also with an external partner—a joint real estate development deal that has accomplished two goals of the university: endowment growth and expansion of our on-campus housing stock. The university has entered into a long-term land lease with a private developer who is building 340 distinctive apartments on the edge of our campus. The partner we selected through this process not only contributed an up-front fee that served to grow our endowment by more than 50%, but also made significant improvements to the campus, including a new classroom building.

Of course, there are as many different solutions to the problem of stagnant or even declining net tuition revenue as there are colleges and universities. But I’d suggest that one thing these solutions will have in common is an entrepreneurial approach that expands the definition of who we are as institutions and what we do. Net/net, it’s both an educational and a survival strategy.

To echo Paul Harvey, “and that’s the rest of the story.”

*Editor’s update: At the end of the 2015-2016 academic year, EF (Education First) decided to close its Atlanta location and consolidate their U.S. operations due to global uncertainty. Having EF on campus for three years had a tremendous, long-term financial impact. EF funded extensive renovations to the basement levels of Hearst and Robinson Halls. EF’s University Transition Program, which helps international students adapt to college in the U.S., continues to funnel new students to Oglethorpe. Revenue from the EF partnership has helped Oglethorpe’s overall financial position. And, EF helped to establish Oglethorpe as a desirable place to do business.